“Past few weekends led to weakness in Bitcoin”, Tom Lees said in a tweet. This has indeed been the trend as Bitcoin keeps struggling to survive. Bitcoin has just started another price correction at the time of writing this article after several weeks of sideways price movements. It has even crashed further since the last weekend and the crypto community has been left wondering what will happen this time.

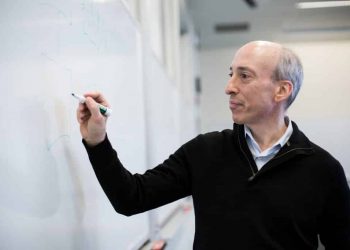

Well, Fundstrat’s head of research Thomas Lee has a word of hope. According to the Bitcoin bull, this weekend promises to be a good one for Bitcoin as the Fed is expected to cut interest rates next week. This he says will make Bitcoin break the struggle pattern and see a rise as lower interest rates weaken the dollar, a situation that is ideal for Bitcoin rise.

Bitcoin rose at the start of the weekend and recorded a 24-hour gain of 3% at the start of the day. Trader and cryptocurrency analyst Josh Rager seems to also have a similar outlook on this but with a bit of reservation.

He says Bitcoin closing the week (weekend) above $10,190 would be a great sign of things to come for Bitcoin in the short term. However, a stronger proof would be a close above $10,854 and failure to break local resistance could bring Bitcoin down to under $9,000.

Some members of the crypto community have also expressed doubt concerning Lee’s prediction. They say the community shouldn’t get too excited for several reasons, one of which is the Senate hearing on crypto this week which could cause a potential dip.

It may be too early to tell what happens next as the weekend has just started and patterns are not clear yet. However, if this weekend repeats the pattern of past weekends, Rager’s sub $9,000 may be a reality or Bitcoin could just remain above $10,000 but with neither significant gains? No way to tell.

All top cryptocurrencies are in red at the moment and while the community hopes this changes into a positive outlook, the market is quite unpredictable and things may change at any time and as the saying goes, hope for the best, prepare for the worst.